Minnesota has a long track record of medical and health care leadership—think Mayo Clinic to 3M to Medtronic. Building on this reputation, the state has become a global hub of innovation and production for medical devices and technology.

In a series of studies, University of Minnesota researchers have mapped and analyzed the state’s medical device industry cluster, exploring its economic impact and the vital role of transportation in its success.

In their latest work, researchers analyzed the economic, community, and supply chain aspects of this cluster, with particular attention on Greater Minnesota. The research reveals that while there is a concentration of companies within the Twin Cities metro area, many companies in this cluster are highly dispersed throughout the state.

“The locational pattern of medical device and linked industries confirms that this industry cluster is an important contributor to the state’s economy, and not just in the Twin Cities but in Greater Minnesota as well,” says Tom Horan, dean of the School of Business at the University of Redlands. Horan is also a visiting scholar with the U of M’s Humphrey School of Public Affairs and a researcher with the Transportation Policy and Economic Competitiveness Program.

Read an in-depth summary of this new research.

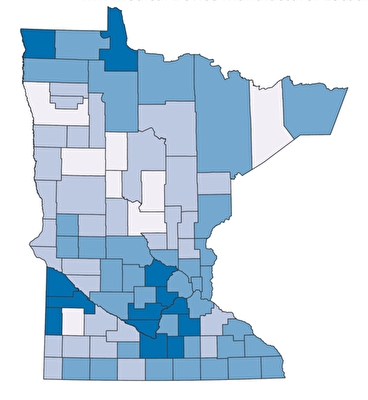

For their analysis, researchers used a location quotient (LQ) to assess the relative concentration of an industry cluster. A score of 1 equals the national average, and any score above that signals above-average concentration.

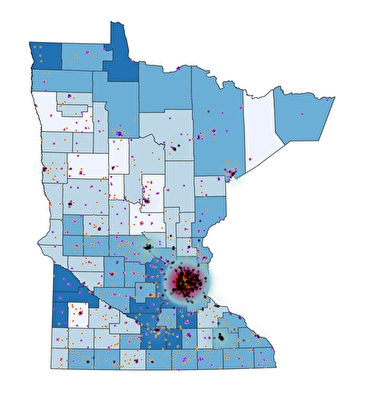

Figure 1a shows the LQ of the Minnesota medical device industry cluster by county. The darker the blue, the higher concentration of medical device-related imports and exports that county has compared with the overall federal average.

Figure 1b shows the spatial location and density of all medical device and linked companies in the state. These linked companies are connected to the core medical device manufacturing companies by supplying plastics, lighting, biopharma, production technology, IT, and metals manufacturing.

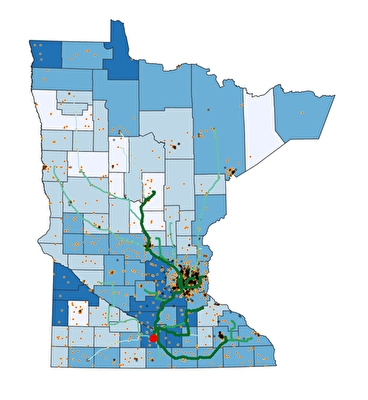

Figure 1c shows the export paths of medical device products from Blue Earth County, highlighting the importance of the surface transportation system in the state.

The research is summarized in an online StoryMap that shows the location and density of medical device companies, linked companies, and hospitals and clinics.

View the Industry Clusters online StoryMap.

The research team also explored industry clusters from the perspective of one company—Granite Partners. “Industry cluster studies have generally focused on economic development and the public policies that can foster it,” Horan says. “What is distinctive about this case study is that it focuses on how industry clusters can drive a business strategy and do so in a manner that has positive implications for communities.”

Granite Partners is a private investment and holding company founded in 2002 in St. Cloud. It made industry clusters a foundational part of its enterprise strategy. Operating partner Pat Edeburn recounts: “I was thinking about what to invest in. What is there in Minnesota?” He came upon industry cluster research from the University of Minnesota, including a paper that identified some of the industries related to medical devices. “We began calling them investment themes,” he says. “We felt that if we invested into these clusters, we would be more sustainable.”

Granite Partners invests in Minnesota platform companies that are strongly tied to Minnesota clusters, then supplements the companies’ organic growth with acquisitions for market and product expansions, capability extensions, and talent acquisitions.

For example, Granite Partners’ platform company Microbiologics recently entered the biopharmaceutic cluster, which is related to its medical cluster. “Through add-on acquisitions, we supplement our ability to compete in the medical device cluster here with biology and biosciences in San Diego and pharmaceutical expertise out of Kalamazoo, bringing it all into Microbiologics’ strategy,” Edeburn says.

“Granite Partners provides an example of the stronger, proactive role a company can play in providing jobs, supporting the community, and putting sustainable practices in place using private-sector resources,” Horan adds. “The public sector plays an important role as well—providing hard infrastructure by funding transportation and soft infrastructure by educating the workforce.”

The case study focused on these aspects:

- Granite Partners’ enterprise strategy, to understand how the industry cluster approach drives competitive advantage.

- Both the hard and soft infrastructure implications of cluster-based economic development.

- How Granite Partners uses a “shared value” approach to promote community engagement by the business.

“Our findings offer valuable insights for policymakers on how this robust industry drives economic development and competitiveness across Minnesota,” Horan says. “They also underscore the importance of infrastructure investment in supporting the cluster’s continued growth.”

Horan presented the research at Industry Clusters on the Prairie: Economic Drivers in South Central Minnesota, a daylong event held in North Mankato in February.

—Pam Snopl, CTS senior editor