The fuel tax is the backbone of our roadway funding system, but its ability to generate revenue is under pressure: more vehicles are using less fuel—or no fuel at all. In response, many states are turning to alternative revenue mechanisms to help bridge the funding gap.

One mechanism is the use of special registration fees for specific hybrid and EV models. “These fees are levied in addition to standard motor vehicle registration fees to ensure that all vehicle owners, regardless of their choice of propulsion, contribute equitably to the maintenance and expansion of the roadway system,” says Camila Fonseca-Sarmiento, director of fiscal research with the Humphrey School’s Institute for Urban and Regional Infrastructure Finance (IURIF).

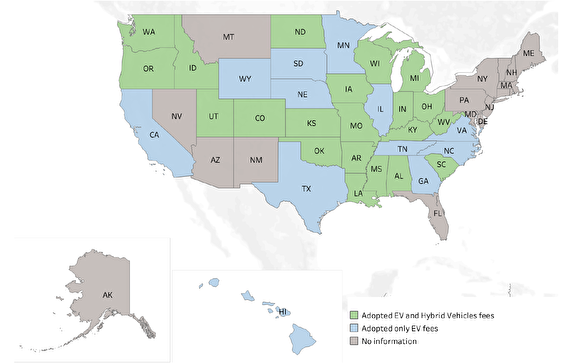

Across the US, 33 states—including Minnesota—have adopted a special registration fee for electric and hybrid vehicles (see map). Overall, revenue collected through these fees are mainly used to support the statewide transportation system, and in some states to support the transportation efforts of local governments (counties and cities). A few states also dedicate some funding to support EV adoption and EV infrastructure such as charging stations.

When states implement registration fees on EVs and hybrid vehicles, the registration fee rate for hybrid vehicles tends to be lower than the registration fee rate for EVs. As of 2023, the average registration fee rate for hybrid vehicles is 60 percent of the average registration fee rate for EVs, Fonseca-Sarmiento says.

Another alternative revenue mechanism is the charge per mile, also known as a mileage-based user fee, distance-based user fee, or roadway user charge (RUC). The fees link taxation to the actual use of the roadway by a driver.

As of 2023, three states have enacted legislation to collect revenue from per-mile charges: Oregon, Utah, and Hawaii. The scope and characteristics vary; in Utah, for example, alternative fuel vehicle owners can choose to pay the RUC instead of a special surcharge.

Some states—such as Minnesota, California, Colorado, Pennsylvania, and Washington—have tested or demonstrated per-mile charges, while others have explored or researched this mechanism, Fonseca-Sarmiento says.

At the national level, the Bipartisan Infrastructure Law requires the US Department of Transportation to conduct a national RUC pilot. Outside of the US, some countries have implemented or are considering RUCs as a mechanism to fund their roadway system. For example, Germany and Belgium have launched RUC systems through tolls aimed at heavy goods vehicles.

The research is summarized in a research note on the Transportation Policy and Economic Competitiveness (TPEC) Program website. Co-investigators for the analysis were Jerry Zhao, IURIF founder and advisor, and Amrutha Shetty, a master’s candidate in data science in the University’s College of Science and Engineering.

Data for the analysis come from the Minnesota Transportation Finance Database, which was created by TPEC researchers and is updated regularly.

—Pam Snopl, CTS senior editor